For all the bank jobs loving applicants here the news is there from UBL Bank Jobs 2018 Current Openings Online Apply Latest ubldirect.com. One of the well-known banks of Pakistan named United Bank Limited is seeking and looking to appoint the well experienced, educated, adroit and capable applicants are required to apply for the following posts such as (Branch Manager, Relationship Managers-Retail and Retail Banking Officers) are the current post which required to apply for the following posts such as (Branch Manager, Relationship Managers-Retail and Retail Banking Officers) are the current post which required to apply for the following posts such as (Branch Manager, Relationship Managers-Retail and Retail Banking Officers) are the current post which required to apply and fill these posts.

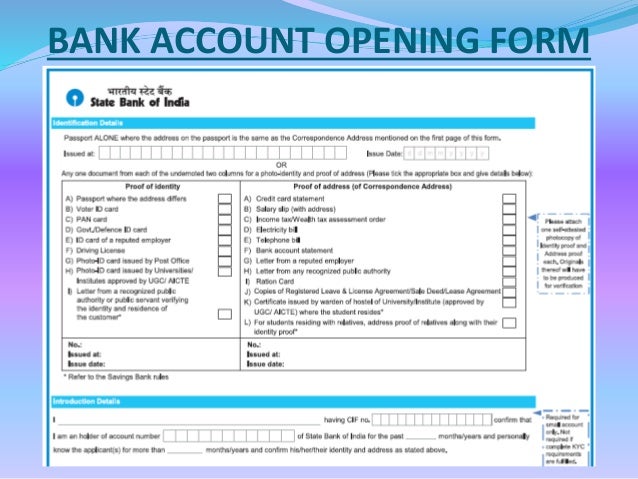

All the posts are Karachi based. This post carries attractive salary package with the suitable environment will be provided to the applicants. Along with males females are encouraged to apply. So after, having such details let's have a look at its applying criteria below. you can view all yours deposit, credit card and loan accounts.

You can pay your utility bills, mobile phone bills, buy prepaid vouchers, invest in UBL Funds, transfer funds to any UBL account holder, transfer funds to any 1Link member bank account in Pakistan, view cheques-in-clearing, manage your ATM card online and shop online at our various partner stores in Pakistan, all from the comfort of your home.

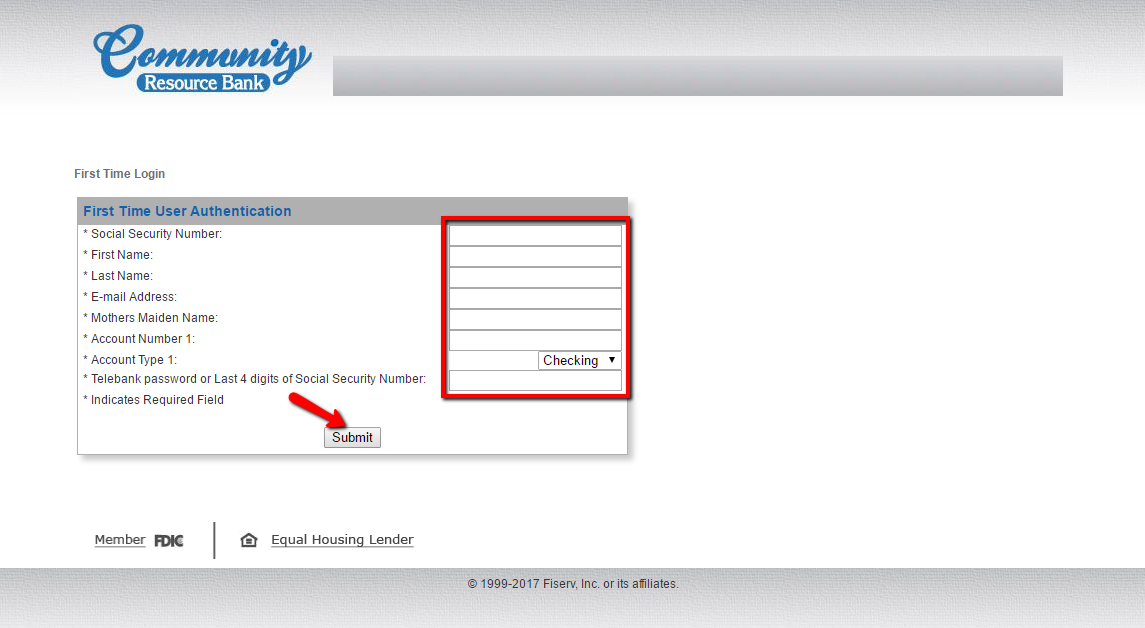

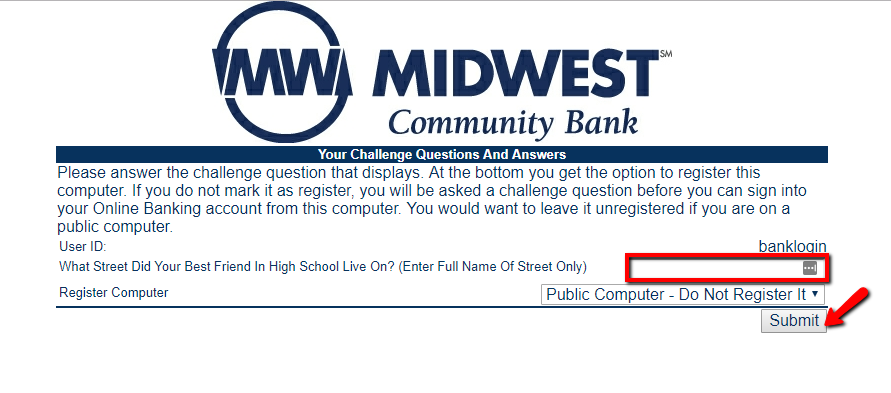

For all the bank jobs loving applicants here the news is there from UBL Bank Jobs 2018 Current Openings Online Apply Latest ubldirect.com. One of the art online banking. Through this facility customers are able to access their account from more than 1200 branches located in 150 cities across Pakistan.

Transactions such as Cash Deposit, Cheque Encashment, Stop Payment, Account Statement, Funds Transfer, Bill Payments are done online without the need to travel to the local branch. With UBL netbanking, you can view all yours deposit, credit card and loan accounts. You can pay your utility bills, mobile phone bills, buy prepaid vouchers, invest in UBL Funds, transfer funds to any UBL account holder, transfer funds to any 1Link member bank account in Pakistan, view cheques-in-clearing, manage your ATM card online and shop online at our various partner stores in Pakistan, all from the comfort of your home.

For all the bank jobs loving